Who Pays Medical Bills After a Car Crash in Tennessee:1Key

The Financial Shock That Follows the Collision

Who pays medical bills after a car crash in Tennessee depends on several factors, and understanding them early can make a major difference in your recovery and finances.

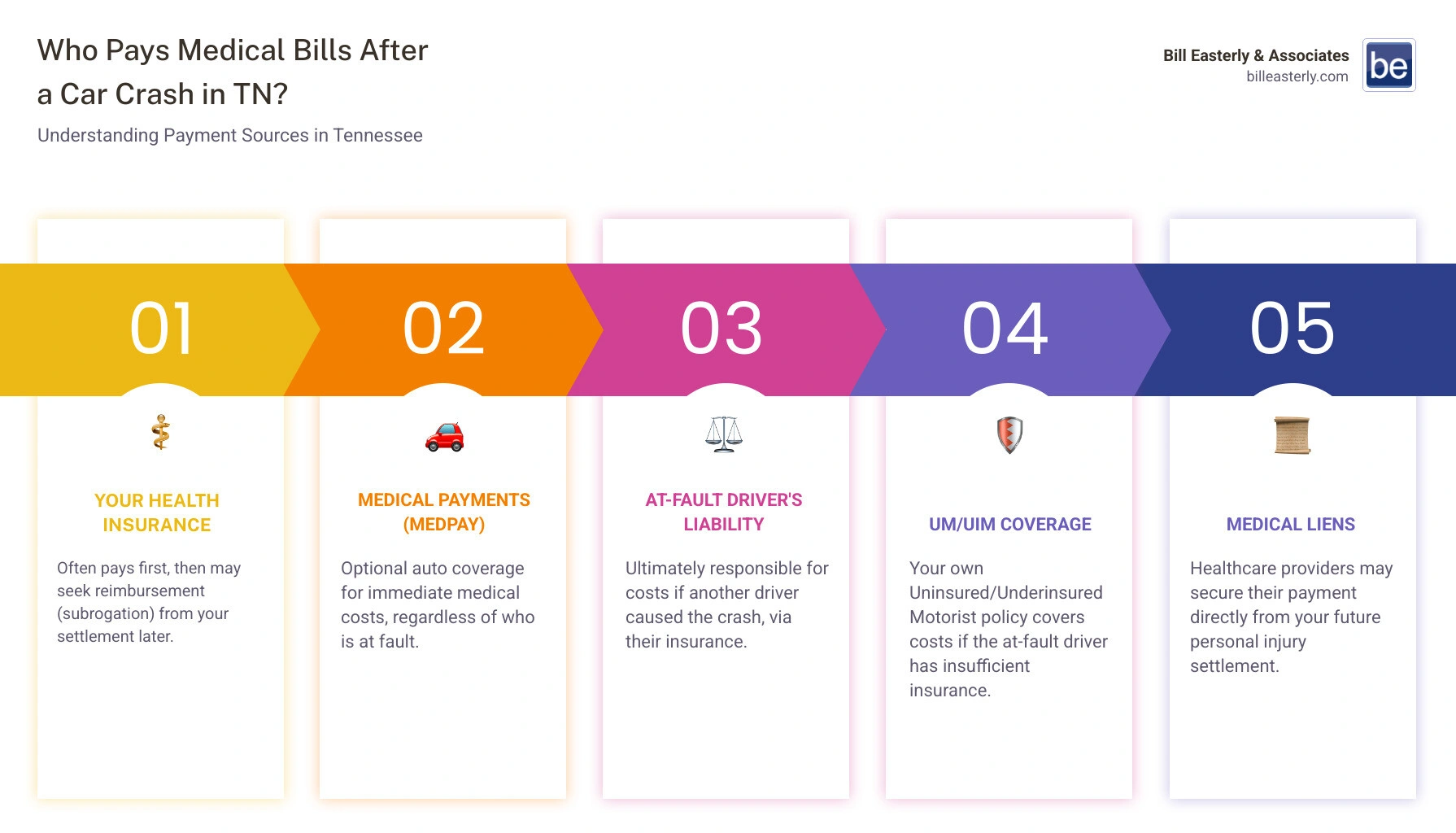

Quick Answer: Payment Sources for Your Medical Bills

- Your own health insurance: Usually pays first, then may seek reimbursement later.

- Medical Payments (MedPay) coverage: Optional auto insurance that covers immediate medical costs regardless of fault.

- The at-fault driver’s liability insurance: Should ultimately pay if another driver caused the crash.

- Uninsured/Underinsured Motorist coverage: Steps in when the at-fault driver has insufficient insurance.

- Medical liens: Healthcare providers may wait for payment until your case settles.

Every year, thousands of Tennesseans are injured in motor vehicle accidents, leaving them with physical pain and immediate financial pressure. Medical bills from car crashes start arriving long before any insurance company writes a check.

If you’re in Nashville, Franklin, or Murfreesboro staring at hospital bills you can’t pay, you’re not alone. The confusion over who pays adds stress to an already overwhelming situation. In Nashville, Franklin, and Murfreesboro, where hospital costs and emergency care rates are high, even a short hospital stay can create significant debt before any insurance reimbursement arrives.

Here’s the reality: Even when another driver is clearly at fault, their insurance company will not pay your medical bills as they come due — you must cover them first and seek reimbursement later. You are responsible for paying them upfront and then seeking reimbursement. This timing gap leaves many Tennessee families in a financial bind.

Fortunately, Tennessee law provides multiple pathways to cover these costs. Understanding your options, from health insurance to MedPay, helps you protect your health and finances.

At Bill Easterly & Associates, we’ve guided countless Middle Tennessee families through this exact situation. We know the local courts and Tennessee’s insurance laws, and we fight to protect injured people. Our consultations are free, and you pay nothing upfront, because access to justice shouldn’t add to your financial burden.

Immediate Steps to Protect Your Rights and Health

The moments after a crash are surreal, but what you do next can make all the difference for your health and your legal rights. It helps ensure the question of who pays medical bills after a car crash in Tennessee is answered fairly.

Your health comes first, always. Get checked by a doctor as soon as possible, even if you feel fine. Adrenaline can mask serious injuries like whiplash or internal bleeding that may not show symptoms for hours or days. Immediate medical attention creates an official record linking your injuries to the accident, which counters insurance company arguments that delayed treatment means the crash didn’t cause your injuries.

Call the police and get an official report. A police report documents the scene, identifies those involved, and provides vital evidence for your claim and for establishing fault.

If you’re able, gather evidence at the scene. Use your phone to photograph everything: vehicle damage, skid marks, traffic signs, road conditions, and any visible injuries. These photos tell the story before evidence disappears.

If you have a dashcam, that footage could be invaluable. Learn more about how Dashcam Footage in Tennessee Car Accident Cases can strengthen your claim.

Exchange insurance information with all drivers involved, including names, phone numbers, insurance companies, and policy numbers. Get contact information from any witnesses, as their independent accounts can be crucial.

Here’s what not to do: Don’t apologize or admit fault. A simple “I’m sorry” can be twisted into an admission of liability. Stick to the facts when talking to others. Be courteous, but don’t speculate on what happened.

Notify your own insurance company about the accident as soon as you can. This fulfills your policy obligations and allows your insurer to explain coverages like MedPay or Uninsured Motorist protection. Be careful about giving recorded statements before speaking with an attorney.

These steps build the foundation for your claim, creating a clear timeline that protects you when insurance companies start asking questions. At Bill Easterly & Associates, we’ve seen how these early actions can make or break a case.

Your First Line of Defense: Using Your Own Insurance for Immediate Bills

It surprises most people to learn that even when another driver is clearly at fault, their insurance company won’t pay your medical bills as they arrive. They investigate and negotiate while your bills are due now. This is where your own insurance becomes a financial lifeline.

Using your own coverage might seem backward, but it’s the fastest way to get medical providers paid while you heal. It acts as a bridge until the at-fault driver’s insurance settles your claim. Let’s look at the coverages that can help immediately.

The Role of Health Insurance for Car Accident Injuries

Your personal health insurance, whether from an employer, a private plan, Medicare, or TennCare, typically covers car accident injuries. This is often your first resource for hospital bills, surgery, and rehabilitation. Your plan’s negotiated rates can lower costs, but you’re still responsible for deductibles, co-pays, and out-of-pocket maximums.

Keep every receipt and explanation of benefits statement. These out-of-pocket costs are part of your total damages, and you can seek reimbursement for them from the at-fault driver’s insurance.

This introduces a concept called subrogation: your health insurance company has the right to be repaid from any settlement you receive. If your insurer pays $50,000 for your treatment, they typically request reimbursement from your settlement once your case resolves. An experienced lawyer can often negotiate these subrogation claims down, leaving more money in your pocket.

How MedPay (Medical Payments) Coverage Works in Tennessee

Medical Payments coverage, or MedPay, is an optional but valuable part of your auto insurance policy. MedPay is no-fault coverage; it pays your medical bills up to your policy limit, regardless of who caused the accident.

MedPay is perfect for immediate expenses like ambulance rides, ER visits, and deductibles or co-pays from your health insurance. Policy limits vary, with many Nashville families carrying between $1,000 and $25,000 or more. For example, a $5,000 MedPay policy might fully cover initial ER visits and imaging, helping you avoid collections while your case is pending. The cost to add this coverage is usually reasonable, making it a smart purchase. Like health insurance, MedPay carriers may also have subrogation rights.

Using UM/UIM Coverage When the At-Fault Driver Can’t Pay

Imagine the at-fault driver who hit you only has Tennessee’s minimum liability coverage of $25,000, but your medical bills are over $100,000. This is a common and terrifying scenario, as minimum insurance requirements haven’t kept up with medical costs.

This is why Uninsured/Underinsured Motorist coverage (UM/UIM) is so important. Tennessee law requires insurers to offer Uninsured/Underinsured Motorist coverage, though drivers can decline it in writing — something we never recommend. UM/UIM pays your medical expenses, lost wages, and other damages when the at-fault driver has no insurance or not enough to cover your losses.

UM/UIM protects you from the financial consequences of another’s irresponsibility. If you have multiple vehicles, you might have “stacked” coverage, which combines the limits from each vehicle for greater protection. For severe injuries like traumatic brain damage, which can require millions in lifetime care, adequate UM/UIM coverage is essential. You can read more about what makes a car accident catastrophic.

At Bill Easterly & Associates, we review every policy to maximize your recovery, often finding coverage you didn’t know you had. We handle the paperwork and negotiations so you can focus on getting better. Our consultations are free, and you pay nothing upfront.

Who Ultimately Pays Medical Bills After a Car Crash in Tennessee: The At-Fault System

While your own insurance may pay bills initially, Tennessee law is clear: the person who caused the accident is ultimately responsible. Tennessee is an “at-fault” insurance state, meaning the negligent driver is legally liable for all damages, including your medical bills. Proving negligence, however, requires a thorough investigation to determine who ran the red light, who was texting, or who failed to yield.

Tennessee’s “At-Fault” and “49 Percent” Comparative Fault Rules

What if you were partially at fault? Tennessee follows a “modified comparative fault” rule, often called the “49 percent rule.” This rule, established in McIntyre v. Balentine, 833 S.W.2d 52 (1992), 57, can significantly impact your compensation.

Under this rule, you can recover damages as long as you are not 50% or more at fault. If you are 50% or more responsible, you recover nothing. If you are less than 50% at fault, your compensation is reduced by your percentage of fault.

For example, with a $100,000 award, if you were 20% at fault, you would receive $80,000. If you were 49% at fault, you would still get $51,000. But at 50% fault, you get zero. This is why insurance companies try to shift blame onto victims; it reduces what they have to pay. For a detailed explanation, read our guide on Comparative Fault in Tennessee Personal Injury Cases.

Filing a Claim and Recovering Damages from the At-Fault Driver

Once fault is established, you file a claim against the at-fault driver’s liability insurance. Tennessee requires drivers to carry minimums of $25,000 per person and $50,000 per accident for bodily injury, plus $15,000 for property damage. These minimums are often insufficient for serious injuries. A single hospital stay can exceed $20,000, and surgeries can cost over $100,000. Lifetime costs for spinal cord injuries can run into the millions.

When the at-fault driver’s insurance is not enough, you must turn to your own UM/UIM coverage or consider a personal lawsuit, though most individuals lack assets to cover a large judgment.

Damages for medical expenses are economic damages, covering everything from ER visits to future medical care. You can also seek non-economic damages for pain and suffering and loss of enjoyment of life. Tennessee caps these damages at $750,000 for most injuries, increasing to $1,000,000 for catastrophic injuries like amputations or severe burns, as detailed in Tenn. Code Ann. § 29-39-102(c).

The Strict One-Year Deadline: Tennessee’s Statute of Limitations

This is critical: you have only one year from the date of your accident to file a personal injury lawsuit in Tennessee. This is one of the shortest deadlines in the country and is strictly enforced. Missing this deadline can bar your right to recover compensation, regardless of how strong your evidence may be. Insurance companies know this and may delay, hoping you run out of time.

While you have three years for property damage, the one-year deadline for injuries is what matters most when medical bills are mounting. This tight timeframe is why you must not wait to speak with an experienced Nashville car accident lawyer. We can immediately start investigating and negotiating while protecting your right to sue. The specific statute is Tenn. Code Ann. § 28-3-104(a)(1). Learn more in our guide on the Tennessee Statute of Limitations for Personal Injury Claims. Don’t wait; every day counts.

Managing Financial Pressure While Your Claim is Pending

The time between your accident and your claim’s resolution can feel endless, especially as medical bills pile up. If you’re in Nashville or Franklin facing bills you can’t pay while trying to heal, know that you have options.

What Happens if I Can’t Pay My Medical Bills?

Many Tennessee families can’t pay all their medical bills while waiting for a settlement. This is a reality of the system, not a personal failure. Unpaid bills can be sent to collections agencies, damaging your credit and adding stress. However, healthcare providers often understand this situation.

Don’t ignore medical bills. Contact your providers and explain that you have a pending car accident claim. Many are willing to work with you. An experienced Nashville car accident lawyer can be invaluable here. Your attorney can negotiate directly with providers, often sending a “letter of protection” (LOP). This legal document promises the provider that their bills will be paid from your settlement. This allows you to continue treatment without immediate financial burden or fear of collectors.

Understanding Hospital Liens on Your Settlement

When a provider agrees to treat you based on an LOP, they place a medical lien on your future settlement. This is a legal right to be paid directly from your settlement funds before you receive your portion. While liens are lifesavers for getting immediate care, they mean a part of your settlement goes to providers.

Here’s the good news: lien amounts are negotiable. A skilled attorney can often reduce the amount owed. Hospitals may bill at full rates but accept less from a settlement, especially when the alternative is a lengthy collection process. An attorney’s ability to negotiate lien reductions can make a major difference in how much of your settlement you actually receive.

Special Case: When the Car Accident Happens at Work

If your car accident happened while on the job, the situation is more complex. Workers’ compensation typically becomes the primary payer for your medical bills and a portion of your lost wages, regardless of fault. However, you may have both a workers’ compensation claim and a personal injury claim against the at-fault driver — known as a third-party claim.

Workers’ comp covers immediate needs but doesn’t pay for pain and suffering or full lost wages; that’s where the personal injury claim comes in. Navigating these dual claims requires careful strategy to ensure you receive all the compensation you’re entitled to under both systems. If your employer was negligent, that adds another layer. For more details, read our guide on What Makes Tennessee Workers’ Compensation Laws Unique?.

Don’t manage these pressures alone. At Bill Easterly & Associates, we handle negotiations with medical providers, insurance companies, and workers’ comp so you can heal. Our consultations are free, and we charge nothing upfront.

Why You Need a Nashville Car Accident Lawyer to Navigate Medical Bills

After a car accident, you’re not just recovering physically; you’re dealing with insurance adjusters, mounting bills, and constant worry. The question of who pays medical bills after a car crash in Tennessee is urgent and personal. Insurance companies are businesses focused on their bottom line, not your recovery. They have teams of lawyers trained to minimize payouts. You need an expert in your corner to fight back.

How a Lawyer Determines Who Pays Medical Bills

When you work with Bill Easterly & Associates, we conduct a thorough investigation to find every possible source of payment. This includes:

- Investigating fault: We gather evidence, review police reports, and consult experts to prove who caused the crash.

- Identifying all insurance policies: We uncover all applicable coverage, including the at-fault driver’s liability, your MedPay, and your UM/UIM benefits.

- Calculating total damages: We work with medical professionals to project your future needs, ensuring your settlement covers long-term care, not just current bills.

- Handling subrogation claims: We negotiate with your health insurance or MedPay provider to reduce what they’re owed, maximizing the money that stays in your pocket.

- Negotiating with adjusters: We speak their language and counter their tactics to prevent them from taking advantage of you.

The Lawyer’s Role in Maximizing Your Financial Recovery

Hiring a personal injury lawyer levels the playing field. While you focus on healing, we handle the legal battle. Insurance companies often make lowball settlement offers quickly, hoping you’ll accept out of desperation before you know the full extent of your injuries. We know the true value of your claim and reject unfair offers.

We take over all communications with insurance companies and other parties, protecting you from saying something that could hurt your claim. While most cases settle, we are always prepared to take your case to trial if an insurer refuses to be fair. Our decades of experience in Tennessee courtrooms mean we know how to present your case effectively.

Most importantly, we work to ensure every medical cost is covered, from the ambulance ride to future rehabilitation. Many people wonder, “Do I Really Need a Lawyer to Help with My Personal Injury Claim?” When facing complex medical bills and strict deadlines, the answer is almost always yes.

At Bill Easterly & Associates, we offer free consultations and work on a contingency basis. You pay nothing upfront, and we only get paid if we win your case. Access to justice shouldn’t add to your financial burden.

Conclusion: Taking Control of Your Recovery and Finances

The road to recovery after a car accident involves navigating a maze of medical bills, insurance claims, and legal deadlines while trying to heal. Understanding who pays medical bills after a car crash in Tennessee is complex, but you now have a clearer picture of the process.

Payment flows through multiple channels: your own insurance for immediate costs, and the at-fault driver’s insurance for ultimate compensation. However, Tennessee’s comparative fault rule and strict one-year statute of limitations create challenges.

The financial pressure during this time can be overwhelming and can even slow your physical recovery. You don’t have to figure this out alone. While you focus on getting your life back to normal, an experienced attorney should be handling the legal and financial battles for you.

At Bill Easterly & Associates, we’ve walked hundreds of Nashville, Franklin, and Murfreesboro families through this process. We know how to negotiate with insurance adjusters and medical providers to protect your financial future. We’re not afraid to go to trial to get you the fair compensation you deserve.

We combine big-firm results with the personal attention of a local Tennessee practice. When you call us, you’ll speak directly with people who understand your community. Our consultations are free, there are no upfront costs, and we only get paid if we win your case.

Don’t let confusion over medical bills add more stress to your recovery. Take the first step toward peace of mind.

Contact a Nashville Car Accident Lawyer at Bill Easterly & Associates today. Let’s talk about your situation and map out the path forward, together.

Reviewed by: Bill Easterly, Esq., Tennessee personal injury attorney

Manual review completed: y